A few weeks ago, four top fashion designers announced that they had agreed to host live shoppable video hangouts using Google+ Hangouts on Air. As those who attended the events relate their experiences, it’s very clear that ecommerce will look very different a few years down the road then what it does today.

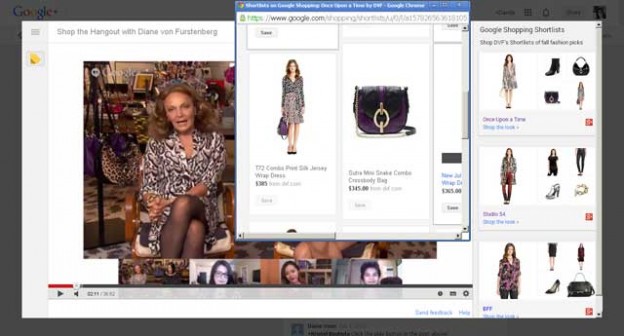

During each event, hangout participants from around the world were able watch their favorite designers talk about their products and hear about upcoming fashion trends. As the designers spoke, the featured items were available for shoppers to browse and purchase along the right side of the screen. There was even the option to add items to the Google Shopping Shortlist for those who weren’t yet ready to buy. The hangout also featured a Q&A session with the designers at the end.

During each event, hangout participants from around the world were able watch their favorite designers talk about their products and hear about upcoming fashion trends. As the designers spoke, the featured items were available for shoppers to browse and purchase along the right side of the screen. There was even the option to add items to the Google Shopping Shortlist for those who weren’t yet ready to buy. The hangout also featured a Q&A session with the designers at the end.

Putting aside my personal opinions about what this is going to do to our off-line existence (why go to the store when you can have such a personalized experience from the comfort of your own home?) it’s very easy to see why consumers will be so attracted to this form of online shopping.

This goes way beyond the online shopping experience to be had on, say, Amazon.com where customers receive personalized product recommendations. As Belle Letz of IPG Mediabrands put it on Twitter, it’s the “Home Shopping Network for the digital age.”

I certainly won’t argue on that one.

The announcement of shoppable Hangouts instantly reminded me of another Google initiative that’s not officially open for business just yet: Google Helpouts. With Helpouts Google wants to connect experts via live video to those who are willing to pay for their advice or assistance. It’s a different service, but the idea behind it is the same: instant, personalized, “face-to-face” online commerce, and it promises to bring a “small business feel” to even the biggest of online retailers.

In short, Google’s Shoppable Hangouts will allow retailers, experts, and other influencers to communicate directly with customers and help to increase brand loyalty as a result. Whatever your personal feelings are about this new trend, if you are running a small business, it’s something definitely worth paying attention to.