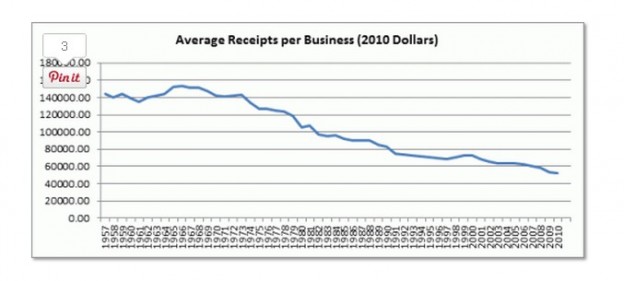

According to statistics of income provided by the IRS, the average revenues of sole proprietorships has been on a downward trend for the last 50 years, with the average sales per U.S. sole proprietorship dropping by two-thirds since 1966. How can we explain these numbers? Does this reflect the state of small businesses since about three quarters of all U.S. businesses are sole proprietorships?

Well… probably not. As alarming as these numbers may seem at first, there may be several explanations, and within them lies a deeper understanding of the trends that have been shaping small businesses over the past few decades.

Well… probably not. As alarming as these numbers may seem at first, there may be several explanations, and within them lies a deeper understanding of the trends that have been shaping small businesses over the past few decades.

One explanation is that the number of sole proprietorships has been increasing faster than the population, driving up the per capita number. In 1957, for example, there were 4.6 sole proprietors per 100 Americans; in 2010 there were 7.5. Part of this increase could be due to greater access to information and streamlined processes for business startup and operation that are readily accessible to the public.

Why would this make a difference? Starting and running a successful business is not for everyone. Many people are quick to quote the statistic from the SBA that half of all small businesses won’t survive past five years. So, it stands to reason as increasing numbers of people try to start businesses (those who maybe shouldn’t be starting them in the first place), it will push up the failure rate. If they hobble along for a few years before giving up, their low earnings could also push down the national average revenues.

Another explanation is that over the past 50 years, LLCs went from being non-existent to being one of the most popular type of new business formed in the United States. This includes many one-person businesses where the owners choose to form an LLC for its flexibility and liability protection. Without LLC numbers, it’s hard to speculate about what the IRS statistics really mean.

The final explanation really revolves around a culture shift: today, more people are seeking supplementary income. This means even if a sole proprietorship isn’t a full-time income generator, it is still being included as such.

Bottom line: there may be more parts to this story than initially meets the eye. Rather than considering the IRS’s numbers as such sombre statistics, they may actually be depicting a shift in the way small businesses today are started and operated.