Irregardless of which side of the political camp you place yourself, chances are the recent “agreement” to raise the debt ceiling probably brings little comfort, and with good reason. Analysis of the deal reveals that the proposed $2.4 trillion in deficit reduction over ten years is a mere drop in the bucket compared to the national debt which currently stands at $14.3 trillion.

But with such astronomical numbers it may be hard to relate to it all in a concrete way. So here is a collection of over 20 unbelievable facts about the national debt and the deficit culled from around the web:

What’s a Trillion, Anyway?

1. If you spend one dollar every second, in twelve days you’d spend 1 million dollars. But it would take you 32 years to spend a billion dollars and more than 31,500 years to spend a trillion. Or you could spend $10 million a day and it would take you a mere 273 years to spend that $1 trillion.

2. A trillion $10 bills, taped end to end, would wrap around the Earth more than 380 times.

3. How big is 14 trillion dollars? 14 trillion $1 bills, laid end to end, side to side, would pave every interstate, highway, and country road in America—twice

*Source: Defeat the Debt

Just Put It On the Tab… A Snapshot of the Yearly US Deficit.

4. According to the US Treasury, as of June 2011, the deficit for FY 2011 is holding at over $970 billion.

5. Projections for the total 2011 deficit peg it at $1.2 trillion dollars.

6. Obama’s most recently proposed budget includes approximately $5.08 trillion in deficits over the next five years

National Debt History 101

7. Before the first session of the U.S. Congress came to an end, the national debt stood at more than $75 million, and since that time it has never been completely paid off.

8. When World War II ended, the debt equaled 122 percent of GDP, or the entire output of the U.S. Economy. In the 1950s and 1960s the economy grew at an average rate of 4.3 percent a year and the debt gradually declined to 38 percent of GDP in 1970. Total US government debt as a percentage of GDP was 94 percent in 2010.

9. When Ronald Reagan took office, the U.S. national debt was only $997 billion. When he left office 8 years later it was $2.6 trillion. During those years, the US went from being the world’s largest international creditor to the largest debtor.

10. Since 1938, the national debt has increased at an average annual rate of 8.5 percent. The only exceptions to the constant annual increase over the last 62 years were the presidencies of Clinton and Johnson. During the Clinton Presidency, debt growth was almost zero

11. With the exception of fiscal years 1998-2001, from 1969 to today, Congress has spent more money than it collected in revenue.

12. The U.S. national debt has more than doubled since the year 2000.

13. Under President Bush: at the end of calendar year 2000, the debt stood at $5.629 trillion. Eight years later, the federal debt stood at $9.986 trillion.

14. Under President Obama: The debt started at $9.986 trillion and escalated to $13.7 trillion, a 38 percent increase over two years.

Anatomy of a Debt Disaster

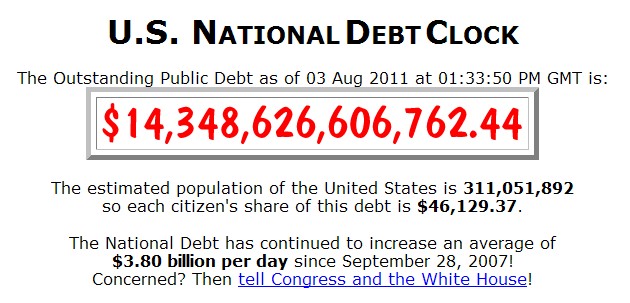

15. The current National Debt is over $14.3 trillion dollars.

16. Since 2006, the U.S. government’s debt ceiling has been raised six times.

17. The estimated population of the United States is 311,044,622, so each citizen’s share of this debt is $46,152.45 (or about $122,029 per taxpayer)

18. Since September 2007, the U.S. national debt rises at an average of approximately $3.8 billion per day and borrows approximately $5 billion every business day.

19. In 2010, the U.S. government issued almost as much new debt as the rest of the governments of the world combined.

20. The U.S. government has such so much debt to unload that the rest of the world doesn’t have enough money to lend. So, the Federal Reserve is buying most U.S. debt, and don’t think that’s too hard. It’s got a ready supply of cash… straight off the mint’s printing presses!

21. The largest lender to the U.S. government is the American people. We currently own about 42.1 percent of the national debt in the form of Treasury bills and the next largest lender is the government itself with 4.6 trillion or about a third of the total debt.

22. The U.S. government has to borrow 41 cents of every dollar that it currently spends.