Even with all the advances in telecommunications that have come our way over the past two decades, such as the prevalence of smart mobile devices, robust collaboration tools, webconferencing, and the rapidly growing field of virtual communication, there are still times when business travel is a must.

While some surveys indicate that technology has made business travel more productive, the reality on the ground is that traveling for business is actually much more complicated then it used to be. Trying to stay connected while you’re away can make even the most experienced business road warrior anxious and frustrated. Business travelers must budget for the extra expenses connectivity incurs and spend more time planning for things like, Wi-fi availability, device recharging, data plans, data security, and even the banning of certain platforms with in some countries.

But with a little forethought, you can overcome many of these hurdles. Here are a few pro tips to consider:

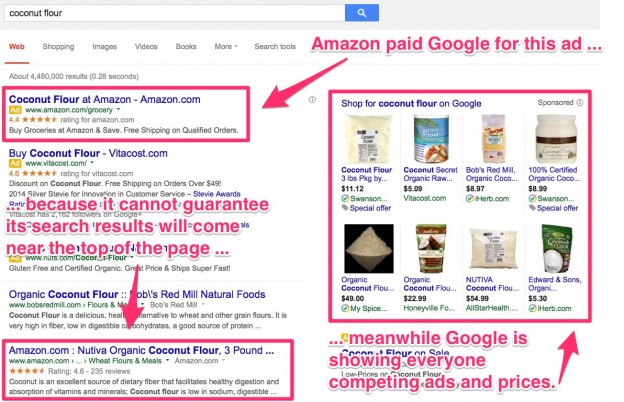

Connect to Wi-fi. One of the first things a business traveler needs is access to the Internet, but the data roaming charges your mobile devices can incur while on the go can easily put your travel budget in a tailspin. Luckily, it’s not so hard to find both free and secured Wi-fi hotspots to use. Most airlines are making Wi-fi available to passengers, and there are numerous apps on the market that can help you locate the closest hotspot.

Just make sure you take the necessary precautions before using an open, unsecured connection- even if you plan on doing “generic” things, like catching up on the latest news. There are plenty of cybercriminals around that regularly monitor free hotspots in the hope that they’ll be able to access the valuable information of some unsuspecting user or better yet, hack into the platforms or systems the user frequents.

When using an open Wi-fi connection, Likehacker offers a few things to keep in mind:

- Avoid connecting to or sending sensitive data, such as site credentials.

- Keep your antivirus and anti-malware system up to date

- Turn Wi-fi off when not in use

- Turn off file sharing and AirDrop options

- Use semi-open Wi-fi networks, like those found in coffee shops and airport lounges.

Alternatively, you could bring along a portable Wi-fi router and create your own Wi-fi hotspot. This may be more secure than a public one. You could also try to tether your laptop, tablet, or other Wi-fi-enabled device to your smartphone and surf the Internet from your phone’s connection.

Access what you need without an Internet connection. With a little planning you can have much of the information and tools you need already downloaded on to your device. Many collaboration tools, location services, and even whole wepages can be made accessible off-line.

Protecting sensitive documents and files. While you are on the road, you’ll likely need access to important business documents, such as presentations, marketing materials, or financial reports. While it may be easier to just download all of these files onto your device, you may want to think again. Practically, anything that’s left on your device can be hacked into- perhaps without you even realizing it. Plus, if you make any changes to these files before uploading or sending them to a different location, and your device is lost or stolen, you will not only loose your work but expose yourself or your business to hacking. In this case, it’s better to rely on cloud storage and collaboration solutions, such as DropBox or SpiderOak.

Keep your data usage low. Turn off any apps that you’re not using, especially those that use data-intensive services like location tracking in the background. Even better, you can turn off cellular data altogether when you don’t need it, to stop any internet connection being forged at all.

Look into data plan travel deals. Many service providers offer special discounts or packages on their data plans for travelers. Some may offer special plans for specific country groups, such as Europe or North America.

Rely on VoIP whenever you can. Like data plans, calling charges can quickly balloon when you have a lot of international calls to make. Before you go make sure you research the availability of special calling plans for travelers. But barring that, one of the easiest ways to keep calling costs down is to avoid making so many phone calls in the first place. One way to do that is to use Voice over Internet Protocol (VoIP) via platforms such as Skype, Google Phone, GoToMeeting and Apple’s FaceTime.

Use a VPN. If you need to travel in country such as China or Turkey, that actively blocks social media, popular apps, or other cloud-based platforms, then the best way around it is to be a part of a VPN. A VPN (virtual private network) provides encrypted links directly to private networks in other countries allowing your computer to behave as though it logged in from a different country

In short, while business travelers have an assortment of sophisticated tools to keep them happy and productive on the road, an added level of planning is necessary to not only make the most of them, but to keep the data that they have access to safe and secure.